Company incorporation checklist: What you need to know to avoid penalties

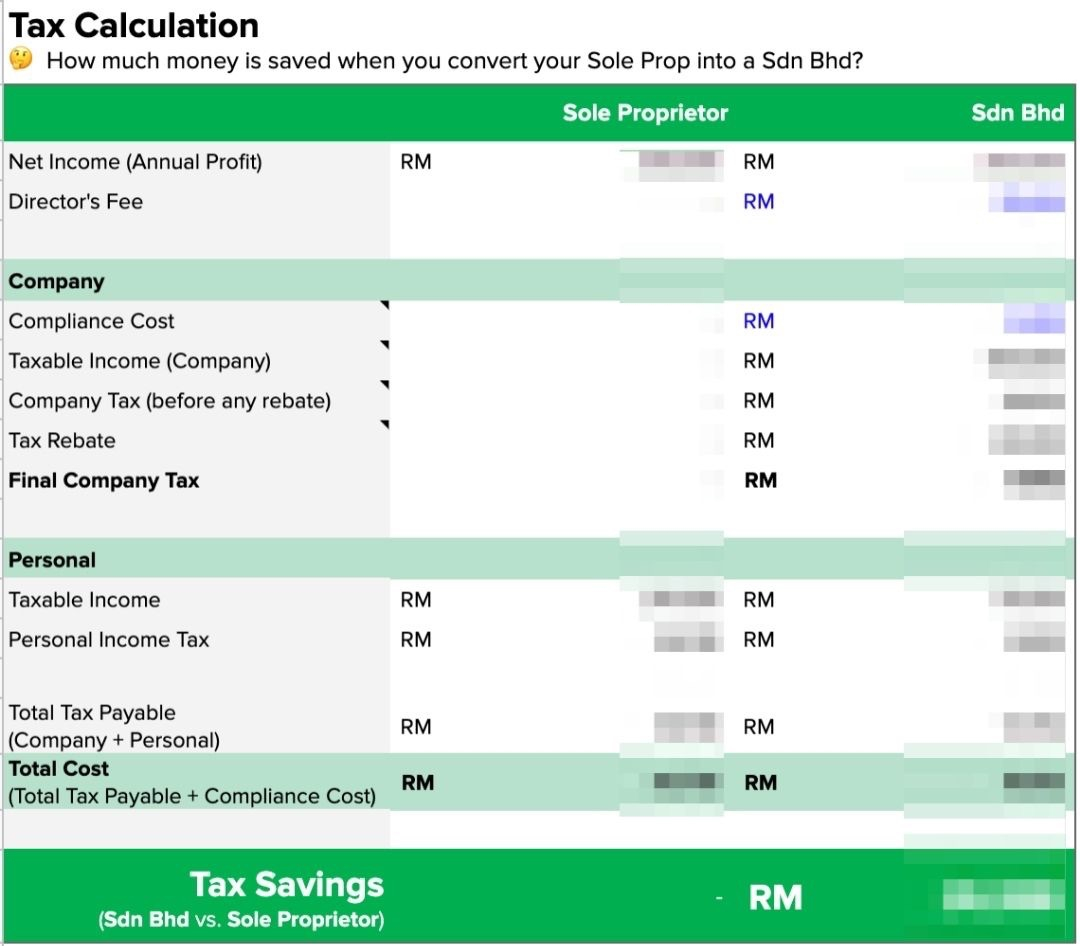

Some of you might know about the tax savings you would gain if you convert your Sole Proprietorship or Partnership to Sdn Bhd by 31st December 2022.

The question most of you might have is – how much would you be able to save?

Also, what are some of the other costs and procedures you need to know when converting your enterprise to Sdn Bhd?

We've collected some frequently asked questions (FAQs) from clients (as well as potential clients) and we're going to address them here.

1. What are the hidden fees involved when you convert to Sdn Bhd? Is it still worth it?

Most people often tell us, yes of course there are tax savings when converting an enterprise to Sdn Bhd, but they know they still need to fork out a lot of costs. Is it still worth it?

Do you end up paying more money due to extra compliance fees, etc? Can you save a significant amount of money in taxes?

The main additional fees you'll need to pay for are:

Incorporation and registration fees: This adds up to RM 1,000 onwards to be paid to SSM, and you can hire a company secretary to do it for you.

- Audit fees: All companies incorporated in Malaysia must have their accounts audited by a Ministry of Finance approved auditor as mandated by the Companies Act 2016. The fees will usually either be calculated based on the company's total assets, gross turnover, or total operating expenditure of the auditing firm. For example, if your gross assets or turnover is around RM 300,000, you might need to pay around RM 1,800 – RM 2,000 in audit fees. You can read more about audit fees in our article on hidden costs of incorporating Sdn Bhd.

- Company secretary fees: When you incorporate your company, it is compulsory for you to hire a company secretary, according to the Companies Act 2016. Your company secretary will be responsible for making sure your company's compliance requirements are met, providing you with the relevant advice when incorporating your company, as well as preparing and filing all statutory documents, annual reports and so on. Usually, company secretary fees can range from RM 80 – RM 200 a month, and are tax-deductible.

- Your tax agent (also known as a tax consultant) will not only help you file your company's taxes but also advise you on what your company can do to save more in taxes. It's important to hire a tax agent as wrong filing of taxes can result in heavy penalties, and in-house accountants can sometimes make these mistakes as well. Usually, if you outsource your company's accounting to an accounting firm, they will be able to offer tax consultancy services and take care of your tax filing too. Tax agent services typically range from RM 1,200 a year and are tax-deductible.

Read more about these hidden costs and procedures here.

We've previously done our calculations and found that if you are earning more than RM 81,000 in annual profits (average of RM 6,750 in monthly profits), it would make more financial sense for you if you register a Sdn Bhd instead of doing business as an Enterprise (Sole Proprietor or Partnership).

All these additional fees and costs of incorporation have been taken into consideration, so yes, overall you will be saving more money in taxes if you incorporate a Sdn Bhd. Find out more with our Tax Savings Calculator below.

Free Tax Savings Calculator

To find out how much tax savings you can get based on your profits, download our Free Tax Savings Calculator below.

2. How necessary is it for you to convert to Sdn Bhd?

If you are regularly earning more than RM 81,000 in annual profits, it would make more sense for you in terms of cost savings to convert your enterprise to Sdn Bhd.

We would also recommend doing so if you are planning to scale your business, because you would be able to benefit from the advantages of incorporating your company. For example, it is much easier for a Sdn Bhd to get approval for a bank loan, or to raise funds.

Ultimately, it depends on the goal of your business and what you want to achieve. If you intend to keep your business as a side business and you might not earn more than RM 81,000 annually regularly, you could keep your business as an Enterprise.

However, if you intend to grow your business and would want to invest more in it, we can advise you on when would be a suitable time for you to incorporate your company.

3. What are the ways company directors can withdraw money from the company?

a. Director's fee

A director's fee is an annual fee paid to the directors and requires shareholders' approval.

Based on our calculations, there's a certain range of director's fee you can declare so as to maximise your tax savings, depending on your company's annual profits. Reach out to us if you are keen to find out more.

b. Director's salary

A director's salary is a monthly fee paid to the directors of the company and subject to EPF, SOCSO, EIS and PCB, and it is based on an employment contract with no approval needed.

c. Dividends

In most SMEs, where the directors are also shareholders of the company, dividends paid to directors would require approval via the director's resolution and is usually given out either biannually or annually.

d. Claiming relevant expenses

Directors can also claim for relevant expenses incurred for business purposes, such as phone bills, entertainment fees, etc, to a certain extent.

e. Borrowing from company

If a director borrows money from the company, it will need to be subject to certain terms and conditions without violating the Companies Act 2016. A reasonable interest rate should be applied.

If the loan to the director is interest-free, LHDN will impose a deemed interest income onto the company, which means the company will have to pay taxes on this interest income even though no real income was made.

So ensure that you are doing this properly. If you are unsure, it is recommended to consult your tax consultant.

f. Director's advance

If a director has previously pumped in money to the company, this sum can be returned to the director through a director's advance.

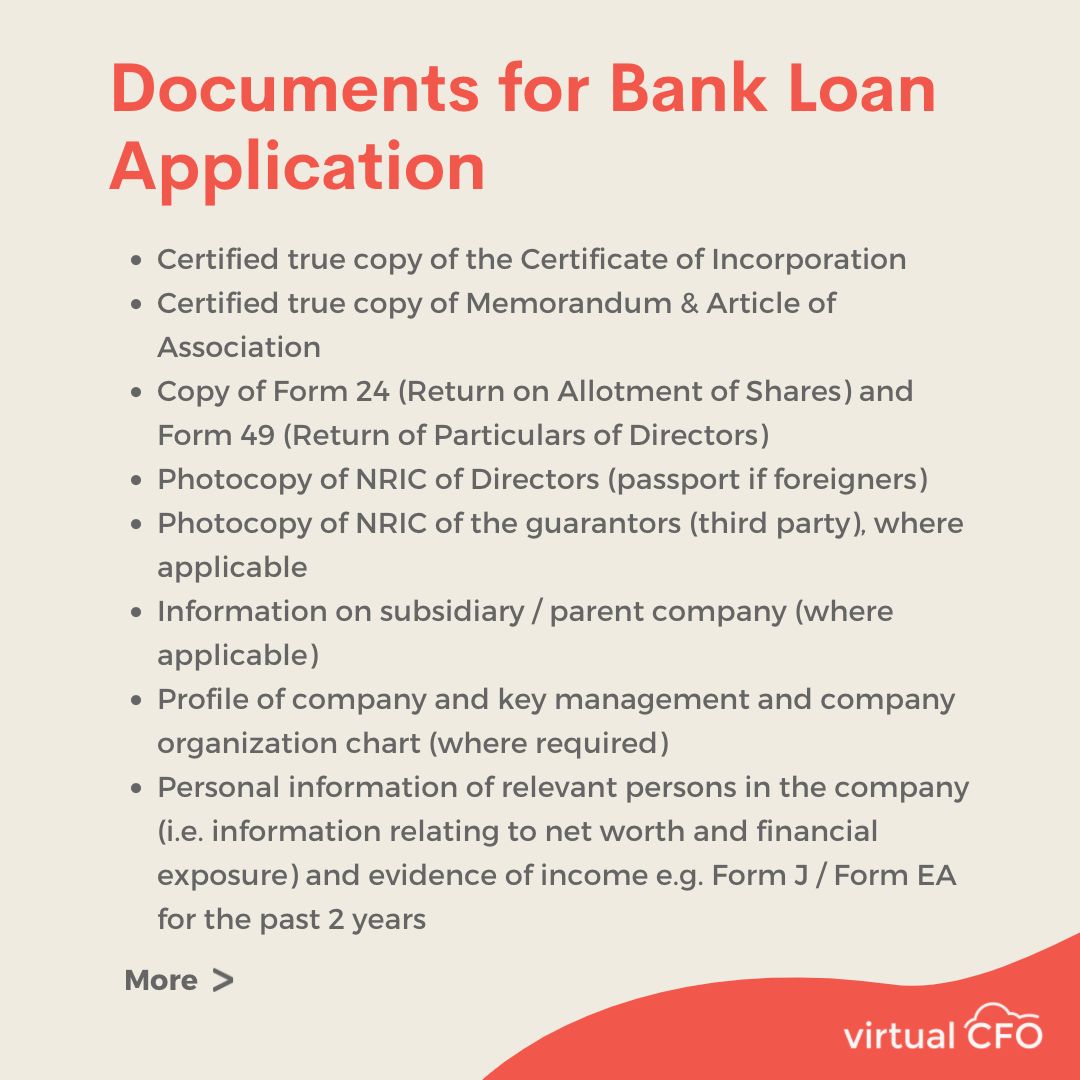

4. Applying for a bank loan? What documents do you need?

If you are planning to apply for a bank loan, in general, you will need the following documents.

The above list provided is a generic one. Different banks will have different requirements and you might need more or fewer documents depending on the bank. We recommend checking with your banker/company secretary who will assist you in handling the paperwork.

In general, it's easier for a Sdn Bhd to get bank loans as your company accounts have been audited, so your company would have more credibility as compared to an Enterprise.

5. What if you need to close the company?

If you need to close down your business, it's important to close your company officially with SSM (no you can't just leave the company as it is – you might incur more fees!).

If you don't officially close your company, you'll still need to pay company secretary fees, audit fees as well as tax agent fees. You'll still also need to file your annual returns and financial reports every year.

Penalties can be incurred if these are not filed and paid.

You can only close your company if you have had no business activities for two years, and after which, you can request your company secretary to strike off or wind up the company. This can only be done if all your shareholders agree to it, your company is not in debt, nor a holding company, and have met all the other necessary criteria. Hence it might take around 6-12 months to properly close down your company.

A good company secretary will be able to better advise you and handle this well so you don't need to stress over the process.

6. What are the requirements to register Sdn Bhd?

Sdn Bhd is an abbreviation of the Malaysian term Sendirian Berhad, which means a Private Limited company. In other words, this means that investors' and shareholders' private assets are not at risk if the company fails.

You need a minimum paid-up capital of RM 1 and at least one director residing in Malaysia who is at least 18 years old. All directors should not be bankrupt nor have been convicted in Malaysia within the last 5 years.

What are the procedures to register Sdn Bhd?

What are the procedures if you incorporate your company with us?

From less than RM 250 a month, incorporating your company as easy as 3 simple and easy steps and we will manage the rest for you:

- Choose a package or discuss with us if you want an ala carte service

- Choose a name for your new company (we will need to get SSM approval)

- Sign the company incorporation documents (which we will send you)

Once the above is completed, we will incorporate your new Sdn Bhd with SSM immediately. After SSM approves the incorporation, within 3 months, the following will have to happen:

We will be appointed as your company secretary within 30 days of successful incorporation.

You will need to decide on your company's fiscal year-end, which can be any date within 18 months from the date of incorporation and we will advise you accordingly.

The entire Sdn Bhd set-up process can be as fast as 2 days if all goes well. If you currently have an existing Enterprise, reach out to us and we will help you transit your Enterprise to Sdn Bhd.

Leave the tedious work to us, so you can focus on your business.

Copyright © 2021 Virtual CFO

Kuala Lumpur, Malaysia All rights reserved.