7 Insider tax-saving tips for online e-commerce sellers in Malaysia (save up to 100% taxes)

E-commerce sellers, are you doing your best to maximise your tax reliefs, deductions and declare your relevant expenses to reduce your tax payable?

Do you know that you can actually do much more than that to pay less taxes legally?

Most entrepreneurs and small business owners who approached us have overpaid their taxes by up to 75%. This means if your business profit is RM 100k, you might have overpaid by RM 13,000 – that's easily the downpayment for a car!

Many business owners are unaware of how to optimise their tax savings because it's simply not their expertise.

Worse, some even get penalised for incorrectly declaring certain sensitive expenses!

Here's some insider advice from a Chief Financial Officer (CFO) who is also a Chartered Accountant on how you can optimise your taxes, besides the reliefs and deductions you probably already know.

These would be useful for you regardless of whether you are managing a niche product brand with your own website or social media, or if you are selling your products on e-commerce platforms like Shopee, Lazada, Amazon or eBay.

And these are insider tips that many other tax-saving posts out there are not telling you!

Read more: 7 Manual accounting mistakes e-commerce sellers need to avoid

1. Sole Proprietor? Incorporating a company (convert to Sdn Bhd) at the right stage can save you up to 100% in taxes

Do you know that if you choose the right business structure, you can potentially save up to 100% in taxes for three years?

Most clients we know who have been selling goods on e-commerce platforms like Shopee or Lazada started off as Sole Proprietors as it's easier. Over the years, as their businesses grow and they start earning good revenue, they start to realise that they are paying more in taxes, due to the tiered tax structure of Sole Proprietorship.

That's when they start thinking, should they incorporate a company (Sdn Bhd) to save taxes?

If you are thinking about this, you are not alone. Many e-commerce sellers often don't know whether the time, effort and money spent to incorporate their company (Sdn Bhd) would be worth the tax savings. This is because they are unaware of how to optimise specific costs so as to gain the maximum amount of tax savings legally.

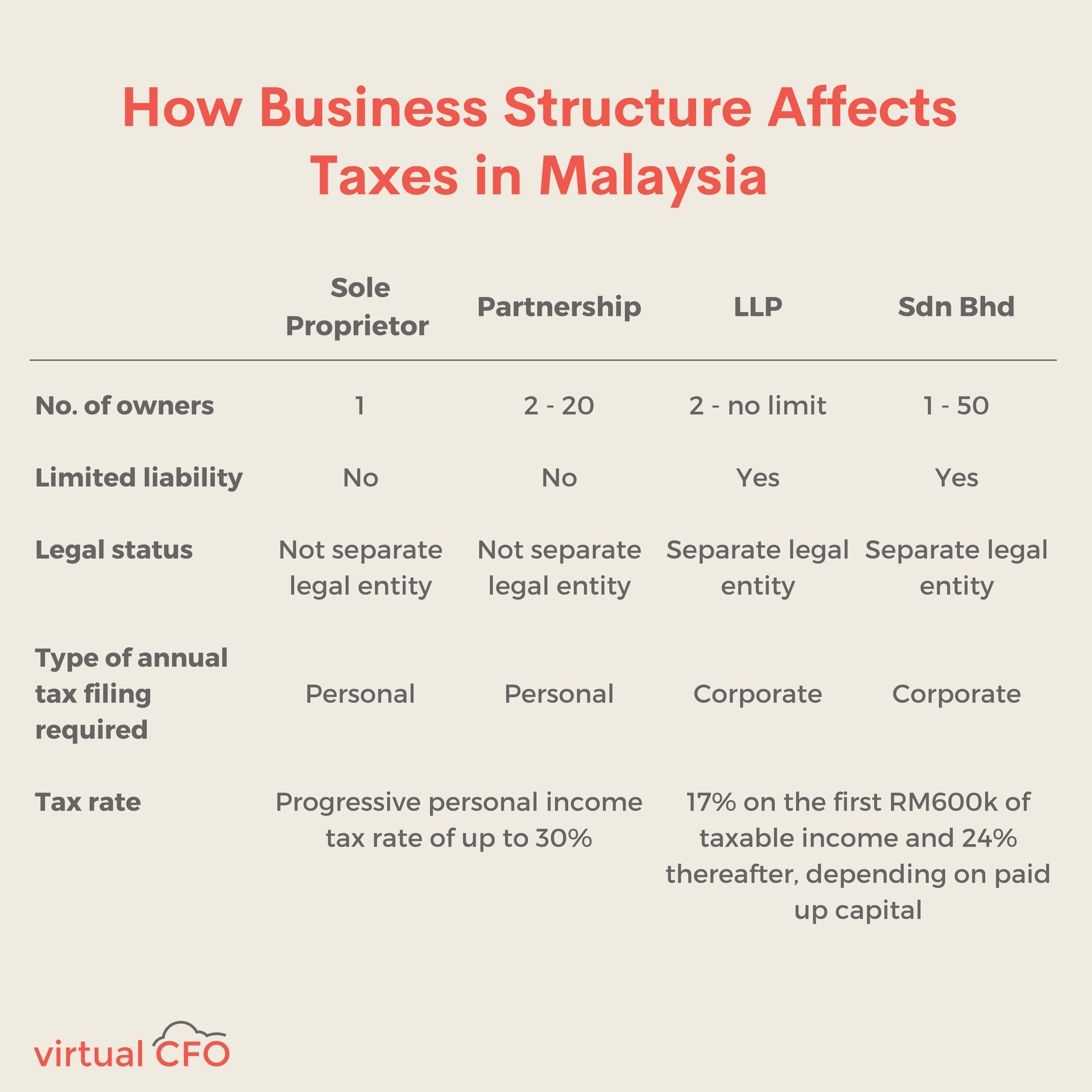

What are the differences between Sole Proprietorship and Sdn Bhd?

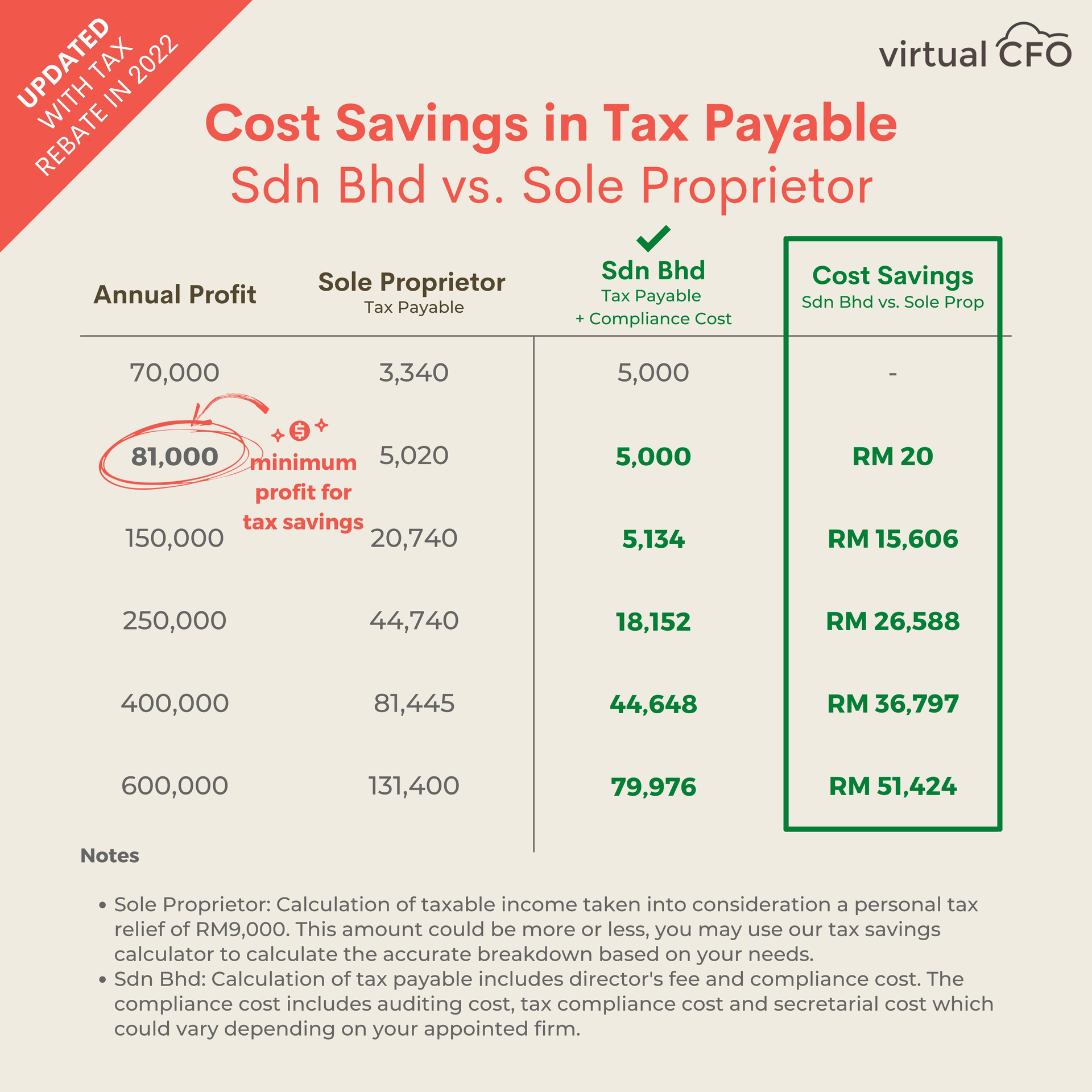

Let's do a quick comparison of the tax rates for Sole Proprietorship and Sdn Bhd:

Sole Proprietorship: Your taxes are tiered, whereby you are taxed up to 21% of your chargeable income for the first RM 100,000, followed by 24% for the next tier and so on.

Sdn Bhd: You will be paying a flat company tax rate of 17% for the first RM 600,000 of your chargeable income.

However, most of you know might also understand there's a lot more to be taken into consideration for a Sdn Bhd, for example, your incorporation cost might range from RM 1500 onwards, not to mention you will need to appoint a corporate secretary costing around RM 1500-RM 2,000 per year, other SSM compliance costs and so on, so you'll need to make the necessary calculations based on your profit and the pros and cons of each structure.

But let's zoom out to look at the big picture. Is your goal long-term tax savings or short term savings? If you are looking at long-term savings, incorporating your company at the right stage is very crucial.

So when is the right stage to incorporate Sdn Bhd?

1. Incorporate your company if your profits are more than RM 6,750/month

Based on our Tax Savings Strategies, using a step-by-step approach to declare a certain range of director fee, if your profits are more than RM 6,750 a month (or RM 81,000 a year), you would actually be able to enjoy more tax savings if you incorporate your company as compared to Sole Proprietorship (due to the tax rebate, which we will mention in our next point).

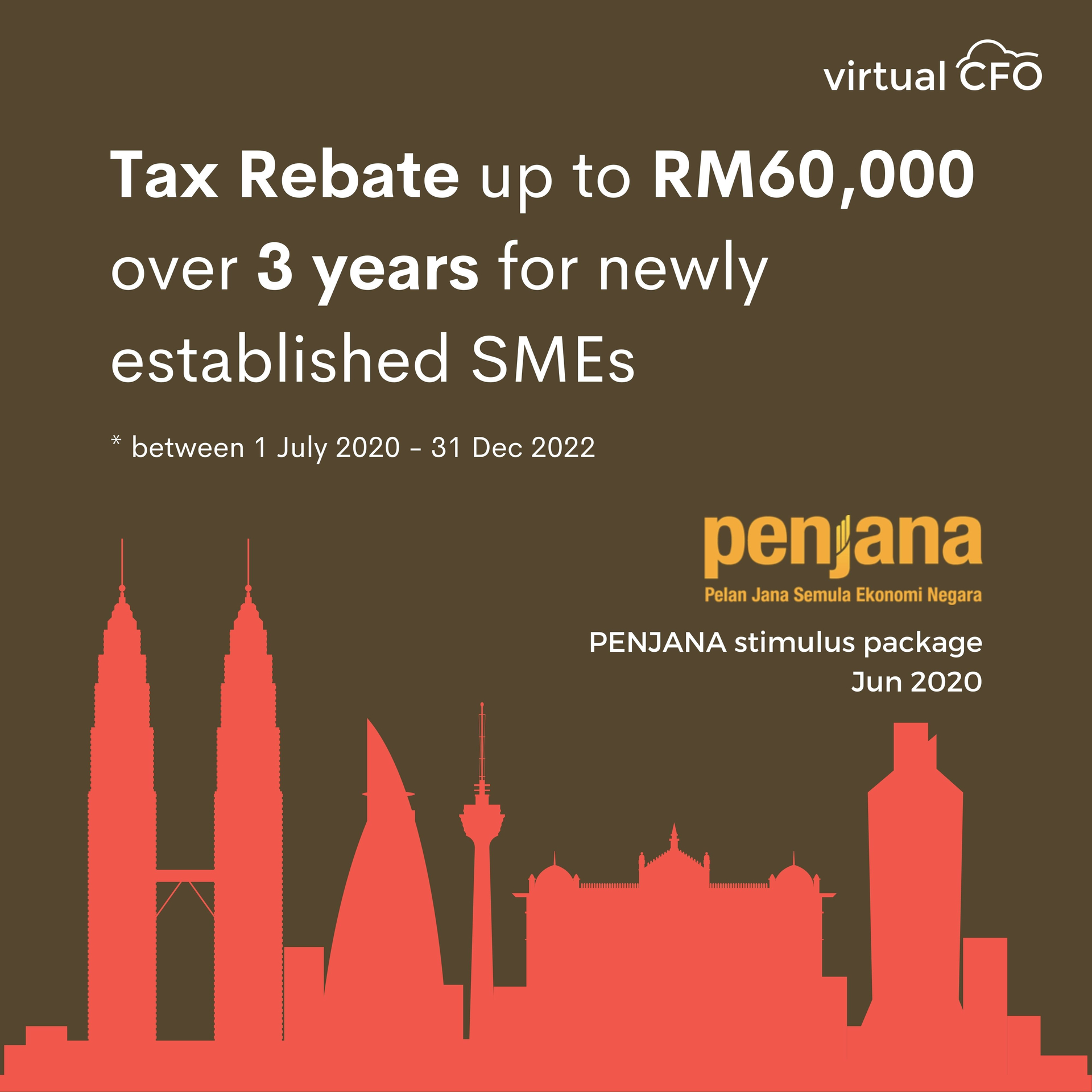

2. If you incorporate your company by 31st Dec 2022, you get a tax rebate!

Did you know that there's currently a tax rebate of RM 60,000 over three years for newly incorporated companies? That means a rebate of RM 20,000 a year – even more savings! This is only valid if you incorporate your company and commence business latest by 31st December 2022.

With our Tax Savings Strategies and tax rebates, you can actually save up to 100% in taxes in the first three years!

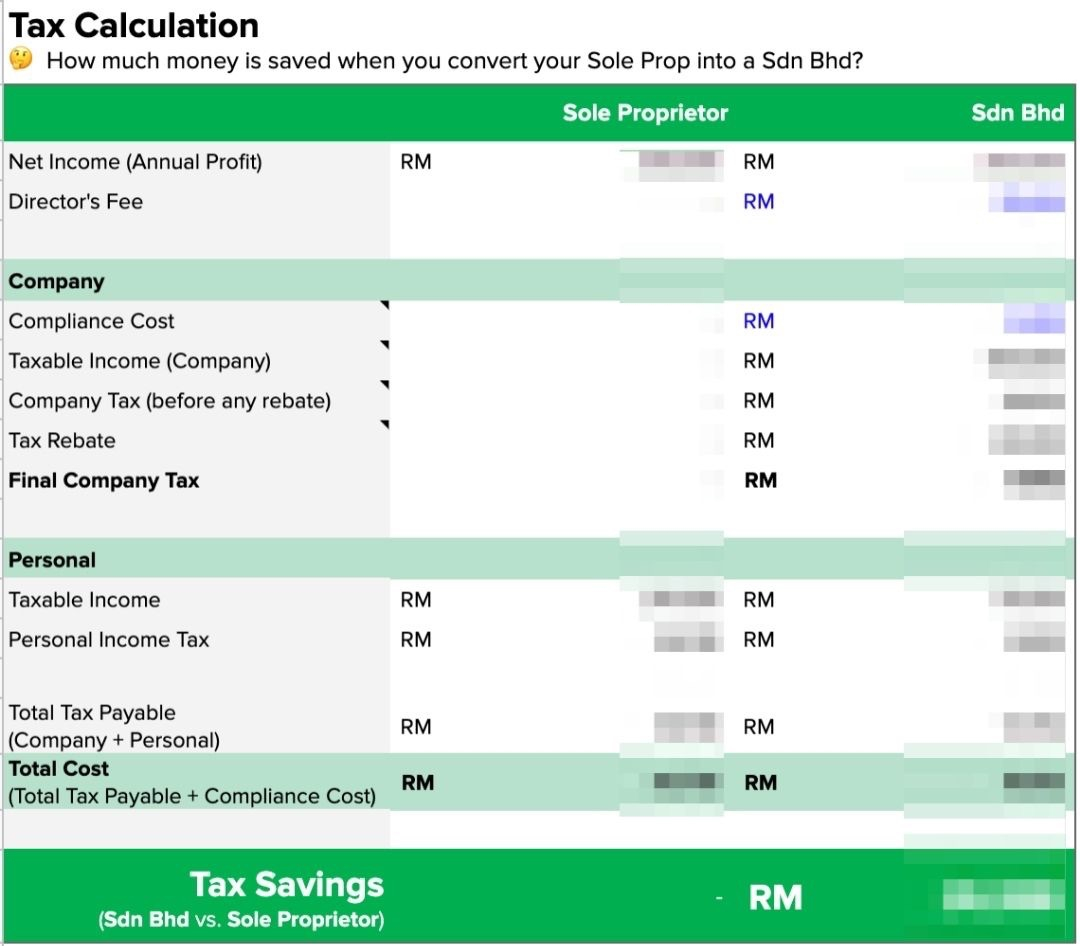

Want to find out how much tax savings you can get if you incorporate your company today?

Download our Free Tax Savings Calculator below.

Read more: Online sellers, here's when you should convert your Enterprise to Sdn Bhd

2. Enjoy tax savings of Sdn Bhd but at lower costs by registering an LLP

Most of you often have this question: What is the best business structure I should go for so that I can optimise taxes and costs based on my current profits and business needs?

Incorporating your company (Sdn Bhd) comes with lots of tax savings and rebates as we mentioned above, but it also comes with its fees, such as hiring a corporate secretary and so on.

So if you want to save on costs but want to enjoy the tax benefits of Sdn Bhd, you can consider registering a Limited Liability Partnership (LLP) instead. Its tax rates are similar to Sdn Bhd, and you can also enjoy the RM 60,000 tax rebate mentioned above.

However, you might not be able to qualify for bank loans easily, nor do crowdfunding, both of which you would be able to achieve easily with a Sdn Bhd – so if these are benefits that you can do away with, LLP might be suitable for you.

To better understand the different various structures, take a look at our comparison table below.

We understand that evaluating what's best for you can be quite overwhelming, especially when you just want to focus on your business. So leave the complex calculations and assessments to us. We have a more complete list of benefits, loans and fundings that would help you better assess which business structures would work best for your business needs.

3. Get transaction records from your China suppliers without clear invoices to avoid paying extra taxes

Many of you might be getting your supplies from China, and here's one problem faced by many of our clients who are also e-commerce sellers – their suppliers from China often don't provide invoices, and transactions sometimes can involve third parties, which makes it complicated to get clear invoices.

Sometimes, to get proper invoices, sellers might even have to pay extra fees and the entire process is just too confusing (and at times too costly).

But you know that if you don't have clear invoices, you might not be able to declare your expenses properly during tax filing season, so you might end up paying extra taxes.

Also, even if you manage to get a commercial invoice, is it enough? What are the other documents you need to support your transaction records?

What you can do:

We often advise our clients to keep their transaction records as detailed as possible so that they are able to use those documents as evidence to support the tax-deductibility of their expenses.

These are the four documents you should be keeping for your transactions:

Commercial invoice or pro-forma invoice

Payment proof for the goods

K1 Form

Custom Official Receipt

4. Are you deducting 100% of your entertainment expenses in your tax filing? Filing this wrongly can land you a fine of up to 300% of the under-declared tax

Do you know that some sensitive expenses when wrongly filed can actually incur tax penalties?

Examples of these sensitive expenses include (but are not limited to):

What you can do:

Not all expenses are fully deductible, so you need to be careful to avoid unnecessary tax penalties, which can cost you up to 300% of your underpaid taxes from wrong filing.

Also, remember to keep all your receipts and invoices. Section 82A(1) and (2) of the Income Tax Act actually requires us to keep our receipts for at least 7 years. Under Section 119A of the Act, the offence of not keeping paper records for 7 years is a criminal offence, which carries a sentence of one-year imprisonment and/or a fine of RM300 – RM10,000!

LHDN does random audit checks once in a while at any time, so you can be penalised even after you have filed your taxes!

5. Claim a percentage of work-from-home expenses

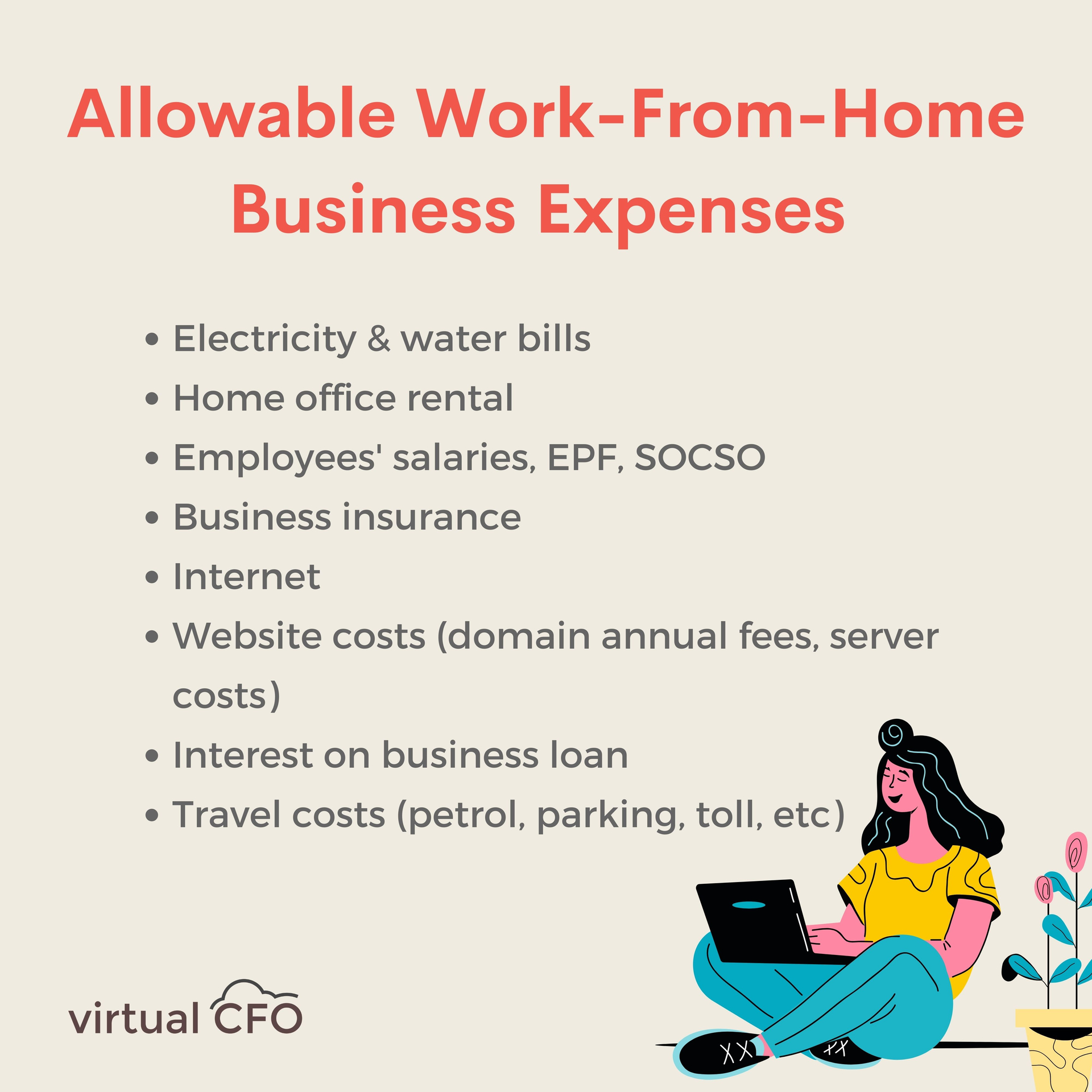

Currently, most of you might be working from home, so you might be able to deduct some business-related expenses like electricity, rent, staff salary, mobile, internet and website costs. You might even be able to deduct travel, car (payments, petrol, parking, toll), food and accommodation costs related to work too.

However, this is only applicable for digital businesses, for which it can be tough to differentiate business and personal expenses when we are working from home.

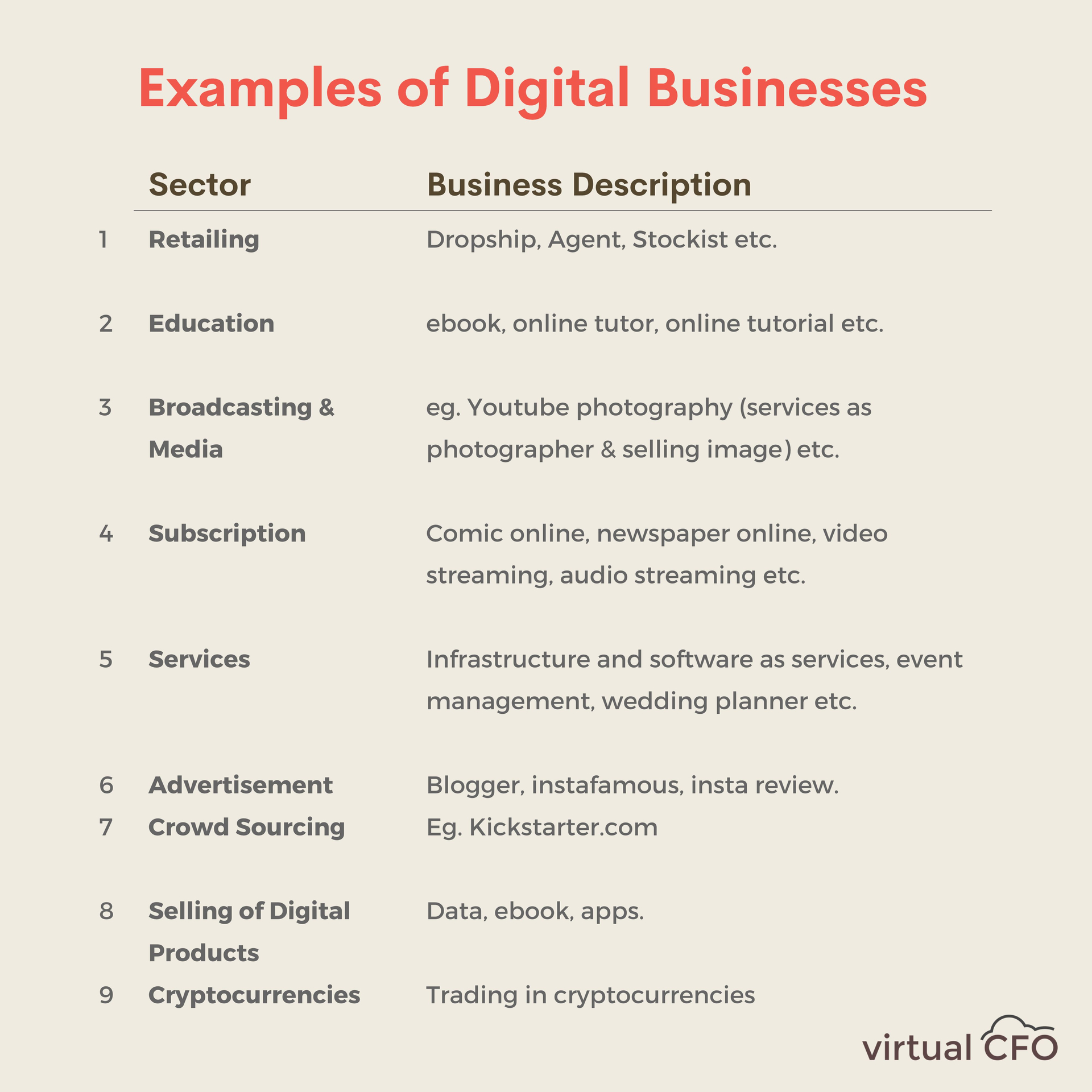

Below are some examples of digital businesses.

Source: LHDN official website

Here are some allowable business expenses you might be able to claim (to a certain extent) if you are working from home:

And do remember to keep all your receipts, invoices and other necessary documents:

However, we must stress some of these expenses might not be fully claimable, depending on circumstances.

It can be a nightmare to figure out how much you can really claim, especially when LHDN is vague about this on their official website. And this is why we are here to help you sort it out, so you can focus on your business in peace.

6. Use accounting software to keep accurate bookkeeping records

Most of our e-commerce clients often find it tough to keep track of real-time data of their sales, especially if they are selling on platforms like Shopee and Lazada, as there might be pricing differences on different platforms, or they might run different promos.

Often, their bookkeeping ends up very disorganised. This gets worse if they don't reconcile their accounts timely. And in the end, this might cause them to wrongly declare their fees and overpay their taxes.

What you can do:

We usually advise e-commerce sellers to purchase accounting software that they can use to connect directly with their Shopee or Lazada accounts and derive real-time data so that they get the most accurate record of their sales as well as save time on all the manual work.

And we work with them to sort out this data, ensuring that their bookkeeping and accounting is in order so that their expenses are optimised during tax filing.

So if you are filing your taxes yourself, you might need to take all these into consideration.

7. Remember to declare necessary fees to optimise taxes

Before you submit your tax filing, remember to review your accounts to make sure that you have declared all the necessary fees to optimise your tax savings.

These fees include (and are not limited to):

Director fee for Sdn Bhd (we have actually done the detailed calculations on the ideal director's fee you should declare based on your profits to get the most optimum tax savings).

Bonus payments for employees – (even if payment might only be given at the end of the year)

Do also review your outstanding debt, obsolete stocks and so on.

How can you save taxes painlessly?

We hope these suggestions give you a better idea of how you can optimise your taxes on a deeper level beyond just your regular deductions and reliefs.

But we also understand, all these paperwork and calculations can be rather confusing and tedious to handle, not to mention you don't want to end up paying extra tax penalties due to wrong declarations!

And this is why we are here for you – we know that as a small and medium business owner, you want to focus on growing your business.

Our professional Chartered Accountant will be able to handle the painful bookkeeping and accounting work for you from just RM 300 a month. This is a fraction of the cost of an in-house accountant and comes with a much higher level of credibility than a freelancer.

In fact, the amount of money you save from working with us might even far exceed what you're paying us.

What are you waiting for?

Copyright © 2021 Virtual CFO

Kuala Lumpur, Malaysia All rights reserved.