How Much Taxes You Can Save From Enterprise to Sdn Bhd?

Find out how much taxes we can help you save.

75% of our Sole Proprietor / Partnership clients overpaid their taxes by 4 figures.

From RM 249/month, we can help you save up to 4-5 figures in taxes.

What if we tell you we can help you save up to 100% in taxes legally, so that you can spend that extra cash on your family, investing in your business, or even on a new car or condo?

Our clients have saved up to RM 20,000 in taxes a year using our methodology and some of them have even used these savings for their second home downpayment and mortgage, or brought their whole family to Europe twice a year.

Another client even invested the 5-figures he saved into financial assets, and now, this amount has compounded to 6 figures.

Here's what we did for our client, Richard Chan, an e-commerce seller.

Richard* has been selling healthcare products on Lazada and Shopee since 2017.

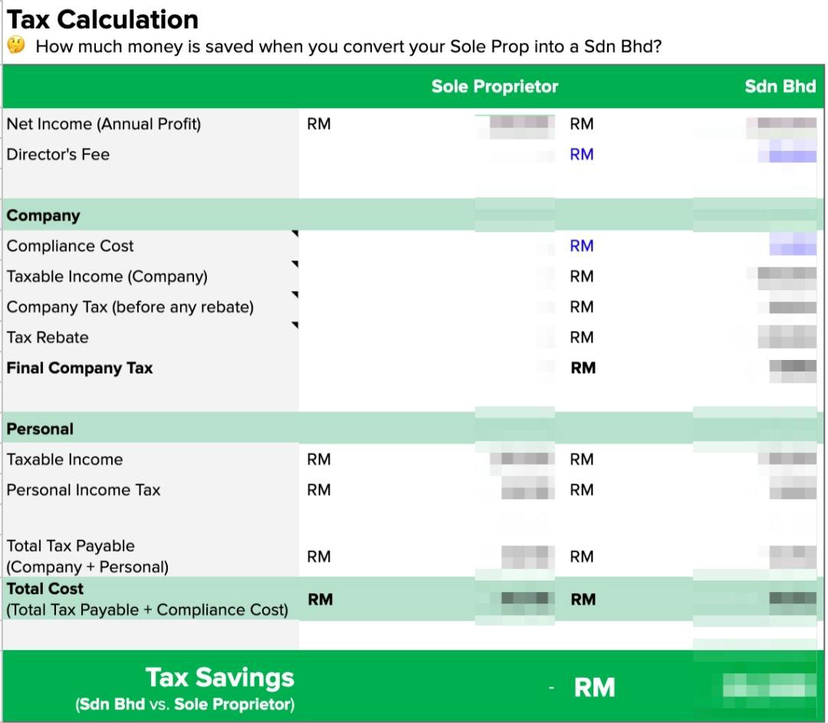

In 2020, he was making around RM 250,000 in annual profits as a Sole Proprietor. This meant paying around RM 45,000 in taxes. After we worked with him to sort out his accounting and taxes, to declare a certain amount of director's fee and compliance cost, as well as incorporated his company, he will only need to pay around RM 18,000 in taxes, which means nearly RM 27,000 (around 60%) in tax savings!

He has since used these tax savings for the downpayment of his new condo near Mont Kiara.

*Name has been changed for confidentiality reasons.

Like what we did for Richard? We can help you achieve the same level of tax savings too.

Want to find out how to stop overpaying your taxes?

This is possible if you:

- Are a Sole Proprietor earning more than RM 12,500 a month in profits (or RM 150,000 a year)

Are thinking about incorporating your company someday but just don't know when is the right time

Based on our Tax Savings Strategies generated by our Chartered Accountant and tax consultant, you can pay less taxes if you incorporate a Sdn Bhd instead of remaining as a Sole Proprietor, provided that your profits are more than RM 12,500* a month.

* Based on an estimated amount of director's fee, compliance cost, etc

We help you figure out the complex calculations.

Leave the tedious job to us, so you can focus on growing your business and enjoy your tax savings.

Ready to stop overpaying your taxes?

Get started with our flexible plans for companies of all sizes.

Starter

Annual revenue under RM 100k

In this package:

Company Secretarial

Annual company secretary fee

Maintenance of corporate records (share certificates, registers and minutes book)

Advice on secretarial, statutory and compliance matters

Accounting

Up to 50 transactions/year

Annual Bookkeeping (Sales, Purchases, Expenses, Director claims)

Annual management reports

Includes Profit and Loss, Balance sheet, Bank reconciliations, Trade debtor ageing & Trade creditor ageing

Tax optimisation and planning

Email & Chat support from a dedicated team

Tax

Tax optimisation and planning

Tax computation

Tax filing (Form C)

Estimation of tax & filing of CP204

RM249 /month *

RM417 /month

40% OFF

* min. 1-year commitment

🤔 More customization options?

Premium

Annual revenue under RM 300k

In this package:

Company Secretarial

Annual company secretary fee

Maintenance of corporate records (share certificates, registers and minutes book)

Advice on secretarial, statutory and compliance matters

Accounting

Up to 100 transactions/year

Annual Bookeeping (Sales, Purchases, Expenses, Director claims)

Annual management reports

Includes Profit and Loss, Balance sheet, Bank reconciliations, Trade debtor ageing & Trade creditor ageing

Tax optimisation and planning

Phone & Chat support from a personal accountant

Tax

Tax optimisation and planning

Tax computation

Tax filing (Form C)

Estimation of tax & filing of CP204

RM339 /month *

RM558 /month

40% OFF

* min. 1-year commitment

🤔 More customization options?

Custom

Annual revenue beyond RM 300k

In this package:

Company Secretarial

Annual company secretary fee

Maintenance of corporate records (share certificates, registers and minutes book)

Advice on secretarial, statutory and compliance matters

Accounting

Unlimited transactions/year

Annual Bookeeping (Sales, Purchases, Expenses, Director claims)

Annual management reports

Includes Profit and Loss, Balance sheet, Bank reconciliations, Trade debtor ageing & Trade creditor ageing

Tax optimisation and planning

Phone, chat and meet up with a personal accountant

Tax

Tax optimisation and planning

Tax computation

Tax filing (Form C)

Estimation of tax & filing of CP204

Contact Us

Frequently Asked Questions

Is it cheaper to manage a Sdn Bhd than a Sole Proprietor / Partnership?

Sdn Bhd is more expensive to manage — you will have to hire a corporate secretary and submit audited accounts to SSM. However, due to the lower flat company tax rate at 15%/17% (for the first RM 600,000 of your chargeable income), if you are earning more than RM 150,000 a year in profit, based on our calculations and reasonable assumptions, and taking into consideration additional costs involved, converting will still save you more money overall.

- For example, if your profits are RM 250,000 a year, you will save around RM 10,000!

Are there any hidden fees I should know?

By setting up Sdn Bhd, you will need to pay compliance costs like audit fees, secretarial fees and tax agent fees. We have considered these in our calculations and we will advise you accordingly based on your situation. You will also need to do bookkeeping according to Malaysia's accounting standards – which we will be able to assist and provide bookkeeping services depending on the volume of business transactions you have.

What are the requirements to set up Sdn Bhd?

You need a minimum paid-up capital of RM 1.

At least one director residing in Malaysia and is at least 18 years old. All directors should not be bankrupt nor have been convicted in Malaysia within the last 5 years.

What are the procedures like?

If you set up a Sdn Bhd with us, it's as easy as 3 simple and easy steps and we will manage the rest for you:

Choose a package or discuss with us if you want an ala carte service

Choose a name for your new company (We will need to get SSM Approval)

Sign the company incorporation documents (which we will send you)

Once the above is completed, we will incorporate your new Sdn Bhd with SSM immediately. After SSM approves the incorporation, within 3 months, the following will have to happen:

We will be appointed as your company secretary within 30 days of successful incorporation.

You will need to decide on your company's fiscal year-end, which can be any date within 18 months from the date of incorporation and we will advise you accordingly.

The entire Sdn Bhd set up process can be as fast as 2 days if all goes well. If you currently have an existing Enterprise, reach out to us and we will help you ensure smooth transition when setting up your Sdn Bhd

Besides tax savings, what are the benefits of Sdn Bhd?

By incorporating Sdn Bhd, you enjoy the following benefits and advantages:

Limited liability – It protects you from risks and protects your personal wealth.

Greater access to capital – It's easier to apply for bank loans through Sdn Bhd and you are often able to borrow money at lower rates than Sole Proprietorship and Partnership.

Easier access to bigger contracts – Depending on your paid-up capital, you are able to tender for bigger contracts.

Better branding – Sdn Bhd is often perceived to be more trustworthy by others than Sole Proprietorship or Partnership.

Easy transfer of ownership – You can easily pass your business to your heirs, families, or friends through the transfer of your shares.

We help you to convert your Sole Proprietor/Partnership to Sdn Bhd (or Limited Liability Partnership, LLP) so that you could save more on tax while growing your company - all with no hassle on your end.

Chat with us to understand how we can help you save tax.

📞 : +6011-6557 8400

⏰ : Mon - Fri 9am - 5pm

Copyright © 2021 Virtual CFO

Kuala Lumpur, Malaysia All rights reserved.