Incorporating your company? Avoid these common mistakes

Business owners, are you thinking of incorporating your company or converting your enterprise to Sdn Bhd?

You can definitely get lots of tax savings (including a RM 60,000 tax rebate!) depending on your profits if you incorporate your company and commence operations by 31st December 2022.

Most of you also understand that there are additional costs and procedures that come with incorporation, but after taking these into consideration, as long as your profits are more than RM 81,000 a year, you will still save more costs overall if you incorporate.

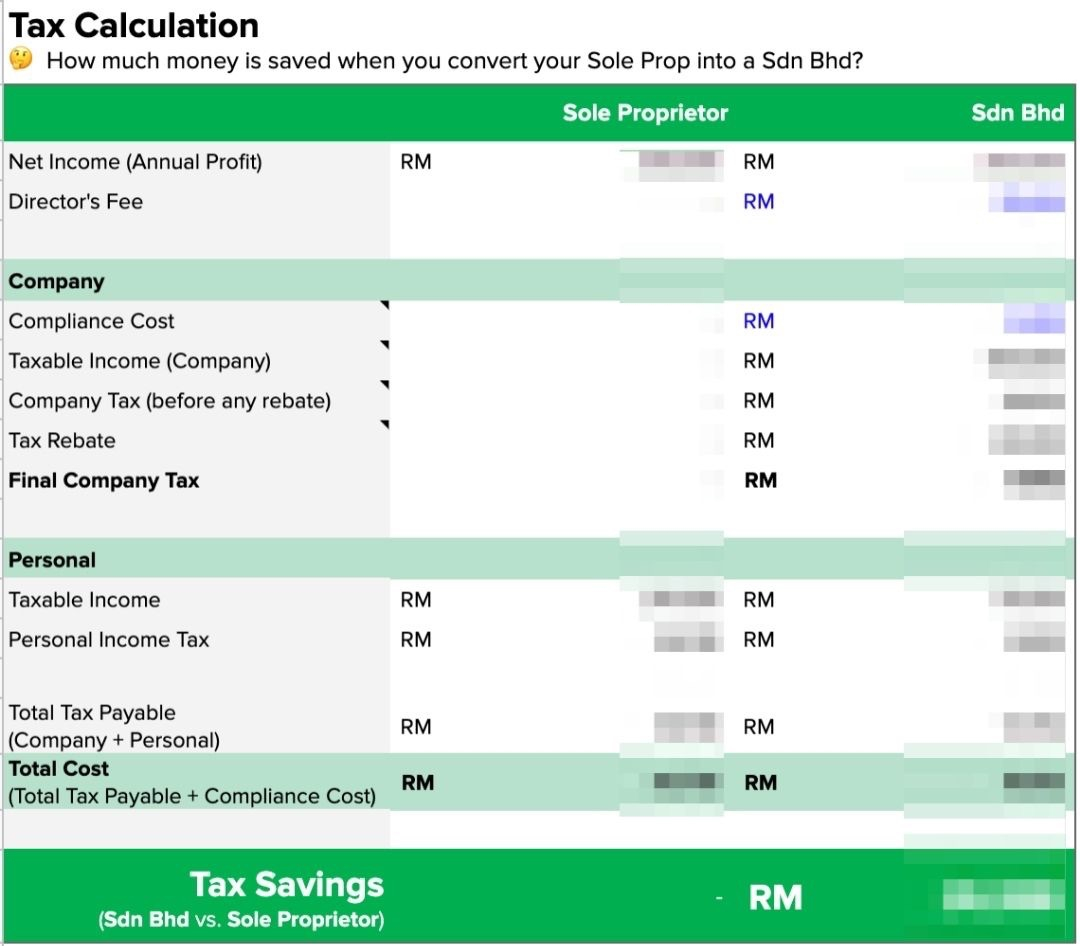

Find out more using our Tax Savings Calculator below.

Free Tax Savings Calculator

To find out how much tax savings you can get based on your profits, download our Free Tax Savings Calculator below.

Here, we've collated a list of common mistakes some business owners tend to make before and after incorporating their company, and we are sharing these so that you can avoid making these expensive mistakes.

P.S. Don't forget to check out our frequently asked questions on incorporation too!

1. Not sorting out director/shareholder issues before incorporation

We have encountered instances when business owners have trouble with their fellow directors and shareholders.

One company was in debt and had a director who held more shares but refused to contribute financially to resolve the company's debt, while another director wanted to resign but could not due to objection by the other director. The directors also had no money to close the company due to the debt that has been chalked up.

This could end up as a very stressful situation for all directors and shareholders involved, as you could chalk up a lot of penalties.

So make sure your agreement with other directors and shareholders is sorted out first with relevant legal documentation before you incorporate your company.

We recommend consulting an experienced business consultant or company secretary who can advise you with these before incorporating your company.

2. Having insufficient capital

Although the minimum paid-up capital required to incorporate Sdn Bhd is just RM 1, depending on the nature of your business, it's important to have enough capital beforehand.

Most new businesses take time to break even and be profitable, so you need to have enough capital for the business to grow at its initial stages.

The lack of capital might also make your business less attractive to potential investors, which might end up limiting your potential opportunities and stunting your business growth.

If you have a low credit score, it might be tough for you to secure a bank loan for your business as well.

So make sure you plan your finances well so that you can focus on growing your business instead of spending time stressing out on keeping afloat.

3. Poor financial management and cash flow

Not managing cash flow well can potentially cause a company to sink into debt.

For e-commerce businesses, sometimes you might require more capital to deal with suppliers, logistics, returns and refunds, etc.

There are also certain fees that you need to pay regularly as a Sdn Bhd, such as EPF contributions to employees, secretarial fees, audit fees, etc, and though incorporation will still give you more savings overall, you need to manage your finances well to ensure that you have sufficient cash flow so as to avoid late payments and penalties.

If you require any help, we will be able to advise you on financial management and help to assess your company's financial health from a CFO perspective.

4. Missing out on necessary procedures after incorporation which can chalk up penalties

Although some procedures after incorporation would be taken care of by your appointed company secretary, it's still important to have a basic understanding of what is required, such as filing annual returns, etc:

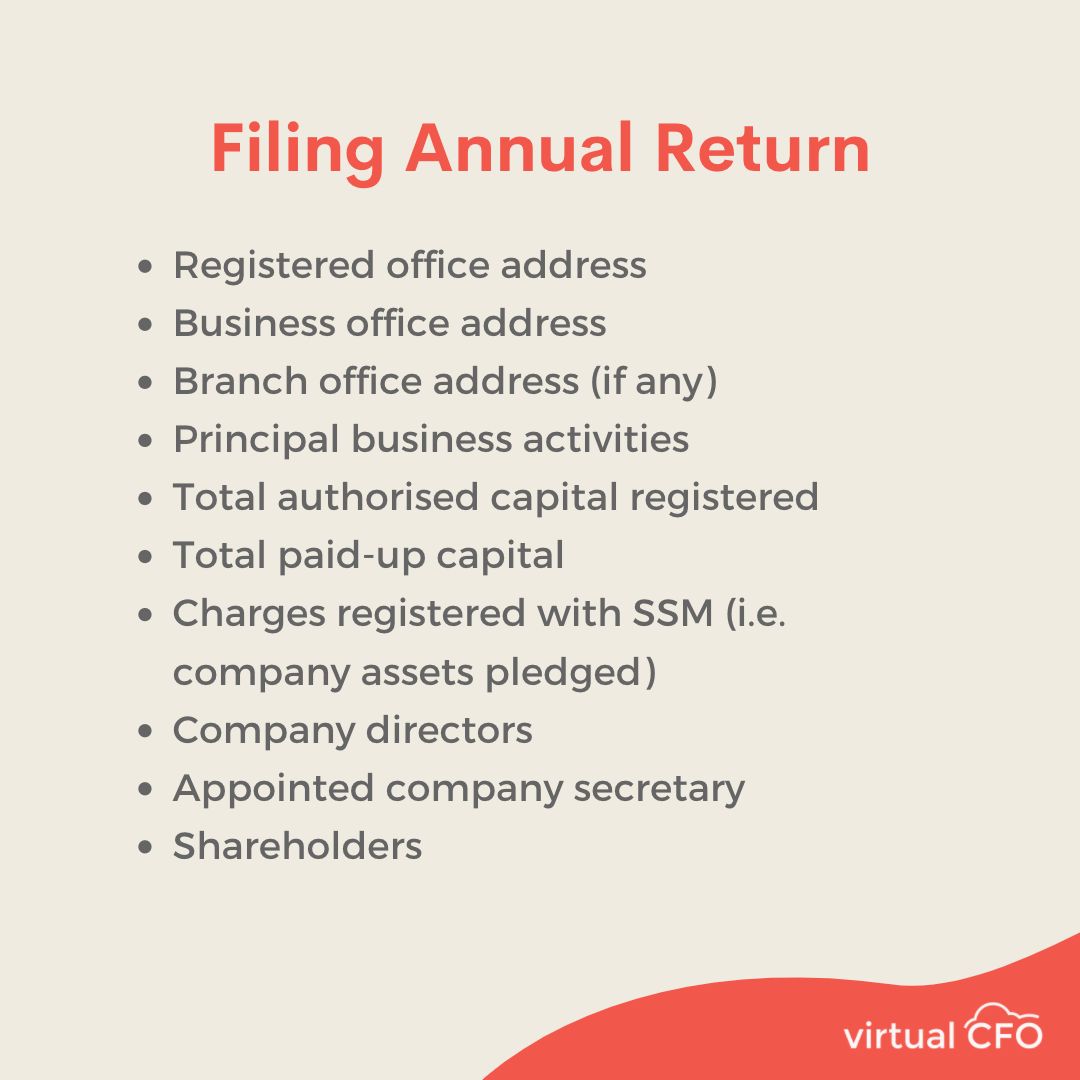

Filing annual returns

According to Companies Act 2016, it is necessary for every incorporated company in Malaysia to file their annual returns every year, no later than 30 days from the anniversary of the company incorporation date.

An annual return will include the following information:

It is an offence if your company fails to submit this, and if convicted, the company, its directors and the company secretary will face penalties up to RM 50,000 under sections 68 (9) of the Companies Act 2016.

However, you don't need to worry if you've appointed a professional company secretary as they will file these for you. You will need to pay a fee of RM 150 to SSM for this filing, but this is usually calculated in your company secretary's fees.

Monthly bank reconciliation

Bank reconciliation ensures payments have been processed and cash collected by the business has been deposited into the bank. The reconciliation statement helps identify differences between the bank balance and book balance so that necessary adjustments can be made.

If this is not done properly, you might not have full visibility of how much money your business actually has, or you might not even have noticed if some money has gone missing!

Proper bank reconciliation will also help to ensure the accuracy of your tax filing and allow you as a business owner to have the most up-to-date understanding of your company's finances so you can better plan for potential funding and/or expenditure.

Your accountant or bookkeeper will be able to handle this for you as well, so you can focus on your business.

Not doing so might cause your books to not be in order, which might result in company directors making wrong business decisions based on inaccurate accounts.

Register with EPF, SOCSO and EIS to ensure that compliance is adhered to

It is important that employers comply with the requirements of EPF (Employees Provident Fund), SOCSO (Social Security Organisation) and EIS (Employment Insurance System) payments for their employees. Having these in place would protect the employees in case of unforeseen circumstances.

If in any situations or circumstances you are unsure of how to proceed with the payments (such as unpaid leave due to the closure of businesses due to Covid-19), it is best to seek professional advice from your company secretary.

5. Not hiring an expert to do your accounting and taxes

Smaller companies tend to depend on freelance bookkeepers to do their accounting and taxes. Some might even resort to doing their own accounting.

Do you know that not getting a proper accountant or tax agent to sort out your accounts and taxes might cause you to run the risk of making mistakes with your accounts and tax filing, which can result in heavy penalties?

One business we know of faced a RM 5,000 penalty because the bookkeeper didn't advise the director to submit a CP204A (the tax estimation form companies need to submit) for the increase in sales in the last financial year.

If you are hiring an in-house accountant, it might take time for your accountant to familiarise himself/herself with your business and processes so that they can develop cost-saving best practices for you.

At vCFO, we have a team of Chartered Accountants, tax agents and company secretaries with 30 years of accounting, tax and financial advisory experience. We will advise you not on accounting, tax savings and/or company incorporation separately, but on everything as a whole holistically so you can make the best financial decision to drive your business to new heights.

What are the procedures if you incorporate your company with us?

From less than RM 250 a month, incorporating your company as easy as 3 simple and easy steps and we will manage the rest for you:

- Choose a package or discuss with us if you want an ala carte service

- Choose a name for your new company (we will need to get SSM approval)

- Sign the company incorporation documents (which we will send you)

Once the above is completed, we will incorporate your new Sdn Bhd with SSM immediately. After SSM approves the incorporation, within 3 months, the following will have to happen:

We will be appointed as your company secretary within 30 days of successful incorporation.

You will need to decide on your company's fiscal year-end, which can be any date within 18 months from the date of incorporation and we will advise you accordingly.

The entire Sdn Bhd set-up process can be as fast as 2 days if all goes well. If you currently have an existing Enterprise, reach out to us and we will help you transit your Enterprise to Sdn Bhd.

Leave the tedious work to us, so you can focus on your business.

Copyright © 2021 Virtual CFO

Kuala Lumpur, Malaysia All rights reserved.